[無料ダウンロード! √] 2290 tax form 2020 186669-What is 2290 tax form

When to file Form MT903 is due by the last day of the month following the end of the reporting period The Tax Department will use the postmarkGet your IRS Stamped Schedule 1 back in July as soon as the IRS begins accepting them Form 2290 is due this year Tuesday Aug 31 but don't wait until then!Forms and Publications (PDF) Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms

How To Avoid Hvut Form 2290 Penalties Blog Expressefile Create Fillable Form W2 1099 Misc 941 2290

What is 2290 tax form

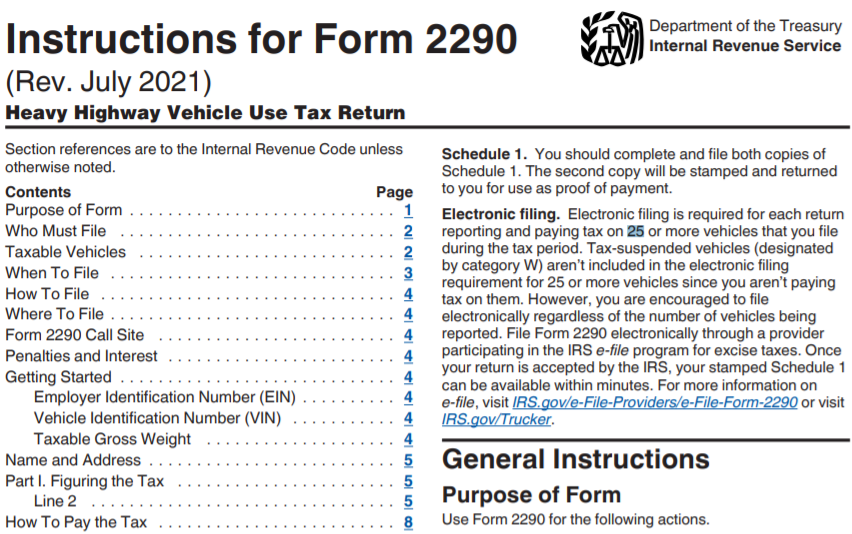

What is 2290 tax form-Quickly efile IRS Form 2290 with ExpressTruckTax and receive your stamped Schedule 1 within minutes Get automatic updates via email or text Get Schedule 1 via email, fax, or mail We will even notify your company/carrier automaticallyInst 2290 Instructions for Form 2290, Heavy Highway Vehicle Use Tax Return 0721 Form 2290 (SP) Declaracion del Impuesto sobre el Uso de Vehiculos Pesados en las Carreteras 0721 Form 2290 (SP)

Etrucktax Form 2290 Filing

Pay your tax by Credit Card with No 3rd party processors or hidden feesWhen is Form 2290 due?May 13, 19 · Get on the fast track, pay and PREFILE your 19 Form 2290 today Since the beginning of the year our customers have asked if they can file and pay Form 2290 tax year 19 The IRS will make the new year 19 forms available until July 1st Therefore, no one can file until then However, you can pay and PREFILE through 2290Taxcom

This entry was posted in 2290 efile provider, Efile, First Quarter Form 7, Form 2290, Form 2290 for 21, form 2290 online, Form 7, Heavy Vehicle Use Tax, Indoor tanning tax, Insiders on Efiling, Schedule1 Copy, Tax Form 2290, Tax2290com, Tax49com, TaxExcisecom, Truck Tax Form 2290, Truckers Need and tagged 21 tax form 2290On the back cover of this publication forApr 09, 19 · Home IRS Form 2290 Due Date for 21 File Form 2290 Online File Form 2290 for Heavy Vehicles annually by the end of the August 31st The heavy vehicle which is running on the public highways must File IRS Form 2290 by the August 31st for the current tax period

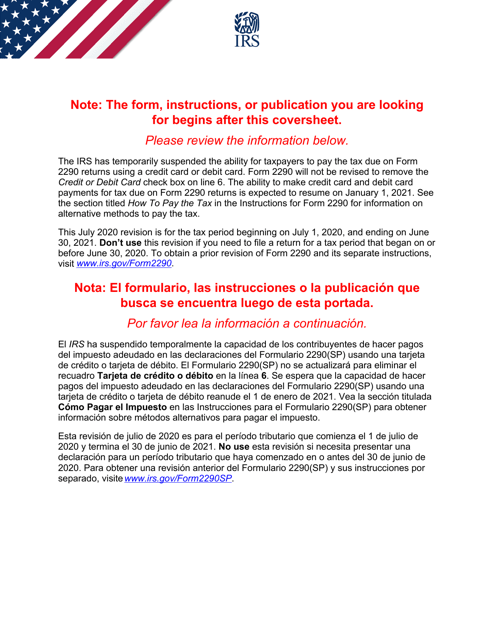

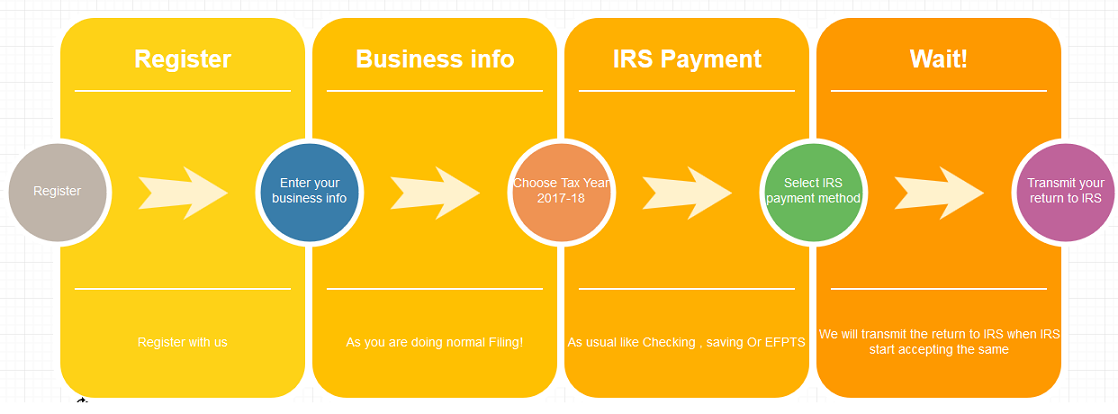

If you have not yet filed your federal heavy highway vehicle use tax return using IRS Tax Form 2290, do not—repeat, do not—send the Internal Revenue Service a paper return—especially if you are expecting IRS Stamped Schedule 1 receipt for the tax year July 1, through June 30, 21This July 21 revision is for the tax period beginning on July 1, 21, and ending on June 30, 22 Don't use this revision if you need to file a return for a tax period that began on or before June 30, 21 To obtain a prior revision of Form 2290 and its separate instructions, visit wwwirsgov/Form2290Jun 30, 21 · Date Posted 1/14/21 The United States federal heavy vehicle use tax (HVUT) must be filed by motor carriers operating vehicles that have a taxable gross weight of 55,000 pounds or more To register, Form 2290 must be submitted to the Internal Revenue Service (IRS) Following the five steps below can make quick work of filing your returns

E File Irs Form 2290 Irs Electronic Filing To Pay Heavy Vehicle Use Tax

North Carolina Form 2290 Heavy Highway Vehicle Use Tax Return

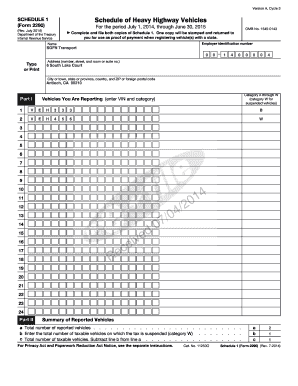

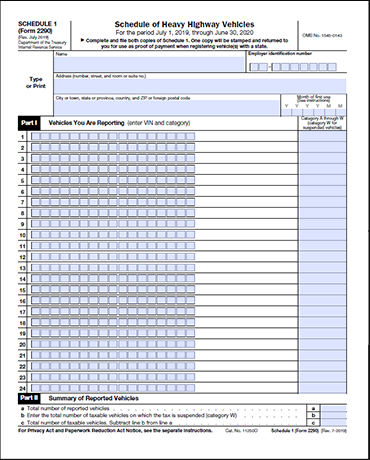

Jul 02, 21 · How to avoid these common mistakes in 2290 filings, and fees Also update on report about multiple efile companies on IRS list operating on what appears to be aIRS Schedule 1 (Form 2290) received back from the IRS that displays the "IRS efile" logo and the "Received date displayed as MM/DD/YYYY" 3 1 The form must list the vehicle identification number or numbers and list the category in which the tax was paidThe /21 tax filing season is now available for prefiling File today, and be first in line!

2290 Tax Form Get Irs Form 2290 Printable Filing Sample Online

Heavy Vehicle Use Tax Form 2290 Federal Applications Processor

Prior Year Products Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printing Instructions for Form 2290, Heavy Highway Vehicle Use Tax Return Instructions for Form 2290, Heavy Highway Vehicle Use Tax Return Instructions forPREFILE HVUT2290 FOR PERIOD 2122 SUPPORT / QUESTIONS?Form 2290 deadline generally applies to file form 2290 and paying tax payments along with the form 2290 tax return for the tax year that begins July 1, 21, and ends June 30, 22 Speed up your 2290 filing process by filing electronically your form 2290 tax return Even you have 1 vehicle do not visit local IRS office file form 2290

What Is Irs Tax Form 2290

Www Pmaa Org Weeklyreview Attachments Cb6 6 19 Heavyhighwayvehicleusetax Pdf

Jun 30, 11 · You must file Form 2290 and Schedule 1 for the tax period beginning on July 1, , and ending on June 30, 21, if a taxable highway motor vehicle (defined later) is registered, or required to be registered, in your name under state, District of Columbia, Canadian, or Mexican law at the time of its first use during the tax period and the vehicle has a taxable gross weight ofHVUT Form 2290 Tax Calculator Toggle navigation FORM 2290 Login Pricing FAQ Contact Live Chat HVUT FORM 2290 Tax Calculator FORM 2290 Tax Calculator IRS Form 2290 Efile 2290 Amendments 2290 Refund Claims Downloads Frequently Asked Questions 2290 Support Center Form 2290 Due Dates Login / Registration CONNECTYou must file Form 2290 and Schedule 1 for the tax period beginning on July 1, , and ending on June 30, 21, if a taxable highway motor vehicle (defined below) is registered, or required to be registered, in your name under state, District of Columbia, Canadian, or Mexican law at the time of its first use during the period and the vehicle has a taxable gross weight of 55,000 pounds or more

Irs List Of 2290 Tax Filing Companies Flawed For Truckers Overdrive

Start 2290 Form For 21 Remind Of Form 2290 Due Date Flickr

Form 2290 is also required when the acquisition of used vehicles is done for the current tax period Vehicles that run less than 5,000 miles (7,500 miles for agricultural vehicles) are considered taxsuspended vehicles and they are not required to pay theForm 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period The current period begins July 1, , and ends June 30, 21 Form 2290 must be filed by the last day of the month following the month ofFor example John uses a taxable vehicle on a public highway by driving it home from the dealership on September 1, after purchasing it John's 'First Used Month' will be September, and he must file Form 2290 by October 31, for the period beginning September 1,

1

Irs Form 2290 Truck Tax Return Fill Out Online Pdf Formswift

IRS Tax Form 2290 for the 2122 Tax Year The truckers prepare their IRS Tax Form 2290 and report the HVUT on heavy vehicles with the taxable gross weight of 55,000 pounds or more The taxable heavy vehicles include the truck tractors, trucks and buses The HVUT rate is $550 per vehicle, which is based on the gross weight of the vehicle's category and the mileage usage limitFor heavy vehicles with a taxable gross weight of 55,000 pounds or more, form 2290 due date is by August 31 of every year For newly purchased vehicles, form 2290 must be filed by the last day of the month following the month of first usePrint 2290 Tax Form Online 2290 Tax Form Heavy Automobile Owners IRS Tax Form 2290 must be filed annually from July 1st to August thirty first September third for 19 for all registered autos Finally, taxable gross weight decides the tax amount the proprietor should pay and may be determined by adding the actual unloaded weight of the automobile fully outfitted for service;

Form 2290 For 19 Truckdues Com To E File Vehicle Use Tax Starts From 7 99

Pre File 21 22 Form 2290 Now Pay Hvut Later

Jul 01, 21 · Efiling for the IRS Form 2290 is now available for the 2122 tax year!Jun 30, 21 · When is form 2290 due?Form DTF95, Business Tax Account Update If you need either form, or any other form, see Need help?

6 Reasons To File Irs Form 2290 Eform2290 Com Blog

Has The Covid 19 Affected The Form 2290 Deadline

The deadline to file Form 2290 and pay the tax is Aug 31, , for vehicles used on the road during July This deadline generally applies to Form 2290 and the accompanying tax payment for the tax year that begins on July 1, & ends on June 30, 21 Generally, efilers receive their IRSstamped Schedule 1 electronically minutes after eCall help@2290info chat wwwdotsosus THE Highway Use Tax, Form 2290 APPLICATION IS NOW OPEN FOR PREFILINGWhen to file 2290 to pay your Heavy Vehicle Use Tax (HVUT) is admittedly a bit complex In general terms, form 2290 is expected to be filed the last day of the month, following the month of your first use 2290 Due Dates for Tax Year 21 IF, in this period, the vehicle is first used during Then, file IRS Form

Irs Form 2290 Due Date For 21 22 File 2290 Now

Pre Filing Season To Commence By June 1st For Hvut Form 2290

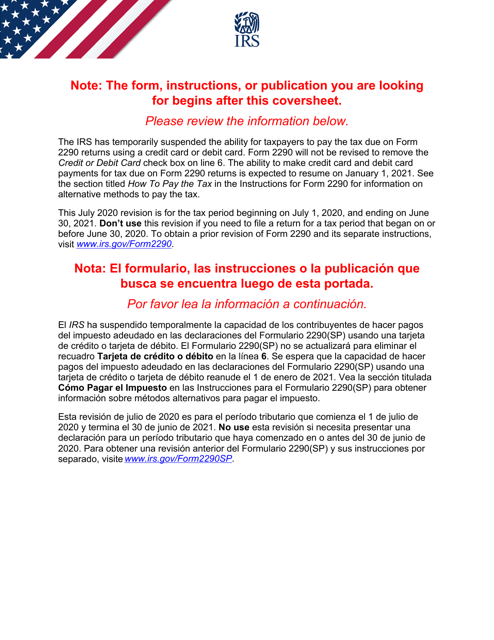

Figure and pay the tax due on a vehicle for which you completed the suspension statement on another Form 2290 if that vehicle later exceeded the mileage use limit during the period;Payments for tax due on Form 2290 returns is expected to resume on January 1, 21 See the section titled How To Pay the Tax in the Instructions for Form 2290 for information on alternative methods to pay the tax This July revision is for the tax period beginning on July 1, , and ending on June 30, 21 Don't useThe Heavy Highway Use Tax for the period of July 21 June 22 can only be paid via a Electronic Funds Withdrawal (ACH) UPDATE THE IRS NO LONGER ACCEPTS CREDIT CARD INFORMATION AS FORM OF PAYMENT FOR FILING FORM 2290

Etrucktax Form 2290 Filing

Efile Form 2290 Heavy Highway Use Tax Irs 2290 Form H

2290 filing is supposed to make your life easier, not more complicated!Form 2290 Due Date for 21 22 The Form 2290 Online Filing Due Date starts from July 1st and ends on August 31st Truckers can File 2290 Online for the entire tax season which starts on July 1st and ends on June 30th of the next year (July 1st, 21 to June 30th, 21)Our tax experts will get your filing done right the first time Staffed to answer your questions and help you by phone from 5 am to 5 pm MF PST;

Form 2290 Deadline Is Fast Approaching For Vehicles First Used In January Tax 2290 Blog

Irs Form 2290 Questions Fill Online Printable Fillable Blank Pdffiller

You've got better things to do – like keeping American industry moving And remember –Aug 26, · The form 2290 for HVUT is mandatory for truckers and is filed each year by August 31 stThe present tax period for heavy vehicles initiates on July 1 st, , and ends by June 30 th, 21 For any newly purchased vehicles, the due date for form 2290 is the month's last day following the first use month of the vehicle For example for truckers using the vehicle inFile Form 2290 for any taxable vehicles first used on a public highway after July by the last day of the month following the month of first use You must have an established employer identification number to file Form 2290 Apply online now if you don't already have an EIN;

Irs Form 2290 Instructions 21 22 What Is Form 2290

Form 2290 Discount Tax 2290 Blog

Aug 24, · Yet to experience the fastest and smarter electronic filing service for Form 2290, to report and pay the Federal Heavy Vehicle Use Tax returns The new standard in 2290 electronic filing is TruckDuescom, 2290 eFile starts at $799 where you can get it done in one go If support needed you can connect with our agents in a call, chat or by emailPre Filing is managing time with your Form 2290 tax filing, advancing the tax preparation and completing HVUT returns for the tax year 21 – 22 now and submitting in the website We shall be holding it until the IRS starts processing 2290 taxes for the 21 – 22 taxAug 31, · Form 2290 payments for the July 1, , to June 30, 21, period were due Aug 31 However, owneroperators and fleets who paid by check won't be getting their Schedule 1 proof of payment anytime soon The notice to the states did not estimate a timeline for the proof of payments to be processed and delivered

Irsform2290 Irs Form 2290 Online Filing For 21 E File 2290

Form 2290 Instructions Truckdues Com To E File Vehicle Use Tax Starts From 7 99

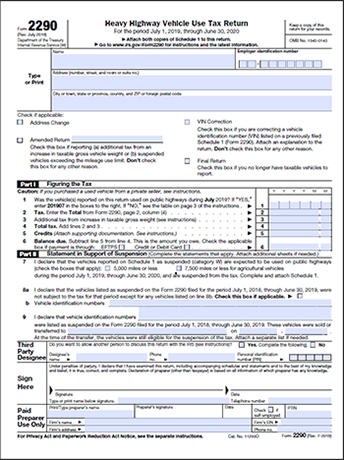

Jun 30, 21 · Form 2290 is used to file tax returns on heavy vehicles that weigh 55,000 pounds or more The due date for filing the tax for the year 21, is between July 1 st, 21 to June 30 th, 21 But it is possible to prefile Form 2290 between June 1 st and June 30 th, 21 to avoid lastminute hurdles and penaltiesBy choosing to prefile your Form 2290 with Tax2efile, you get toJun 25, 21 · Use Form 2290 to Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more;Figure and pay the tax due if,

File Irs Form 2290 Online For 19 Irs Forms Etax Irs

3 11 23 Excise Tax Returns Internal Revenue Service

It takes us about two weeks to establish new EINsIRS Form 2290 Online for 21 Paying Heavy Highway Vehicle Use Tax and getting Printable 2290 Form Schedule 1 is now within minutes Therefore, Form 2290 Online Filing started for the Tax Year 21 as quick as possible Truckers can file HVUT 2290 Form with 2290 Fling Online Furthermore, IRS Free efile Form 2290 is now possible with the irsform2290onlinecom To payHighway use tax registrations, by accessing One Stop Credentialing and Registration – OSCAR – (at wwwoscarnygov) To download publications, forms, and instructions, and to obtain information updates on New York State tax matters, visit our Web site (wwwtaxnygov) See Need help?

Truck Tax E File Form 2290 Online

Form 2290 For 19 Truckdues Com To E File Vehicle Use Tax Starts From 7 99

The Form 2290 tax filing season started on July 1, The IRS started processing the 2290 tax returns and urged the Truckers to choose electronic filing The IRS is reminding truckers and other owners of heavy highway motor vehicles that in most cases, their federal heavy highway use tax return reported on Form 2290 is due on August 31,Aug 24, · Tax Form 2290 is a federal vehicle use tax filed on all heavy motor vehicles that is used on a highway across the country, that weights 55,000 pounds and more This is reported between July 1 through June 30, paid in full for these twelve months Usually this tax falls due for renewal or payment in July 1 to August 31Requirements to File IRS Form 2290 Any heavy trucks that operate on the public highways are subjected to Federal Excise Tax called as IRS Form 2290 A tuck that weighs 55,000 pounds or more and is used to 5000 miles or more must pay this federal tax This tax is collected annually and the same is used for maintenance and construction of highways

1

Got A Letter Or Notice From The Irs For Your 2290 Tax Filings Truckdues Com To E File Vehicle Use Tax Starts From 7 99

We'll save you time, paper, and needless frustration Get out of those IRS lines and back onto the road!Jul 01, 21 · You can now file IRS HVUT Form 2290 online for the 21 tax period IRS authorized & marketleading efile provider Efile 2290 Simple, secure, and accurateRemember that all carriers with 25 or more vehicles with registered gross weights of 55,000 pounds or more must electronically file Heavy Vehicle Use Tax Form 2290 Note A filing (or return) is completed once you receive your schedule 1, generally within minutes

3 11 23 Excise Tax Returns Internal Revenue Service

Form 2290 Schedule 1 How Do I Get A Copy Of My Paid 2290

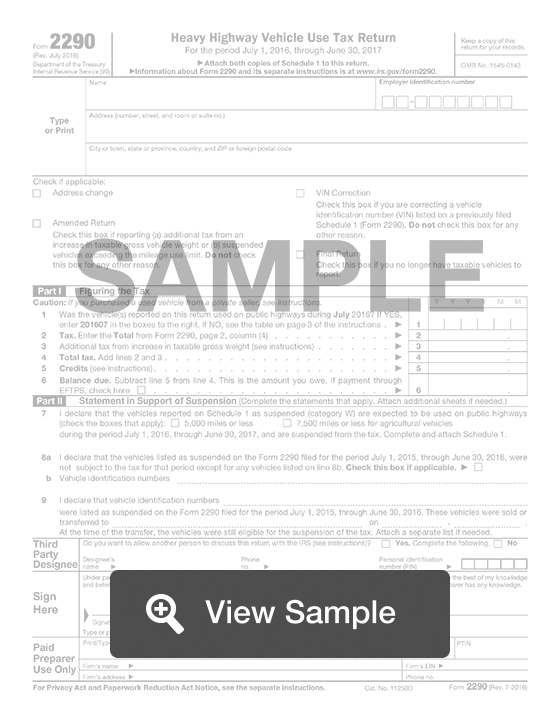

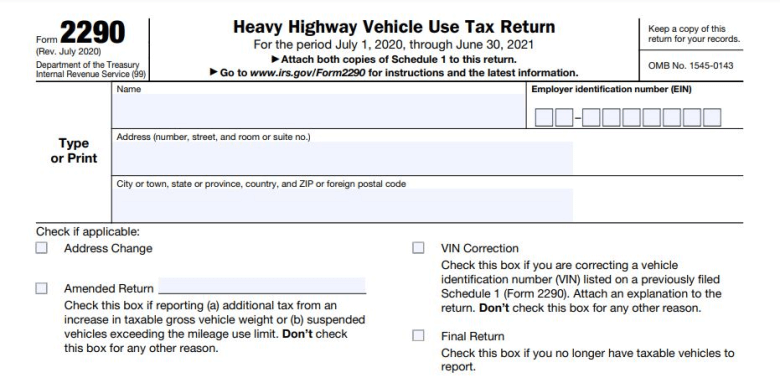

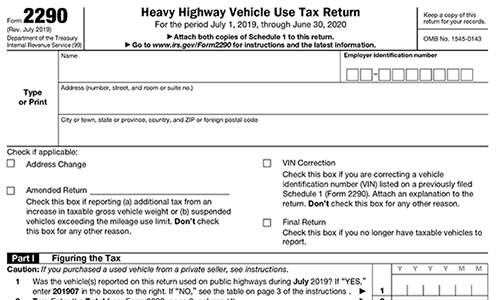

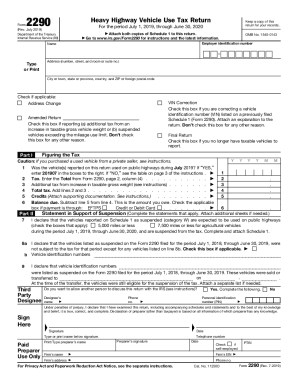

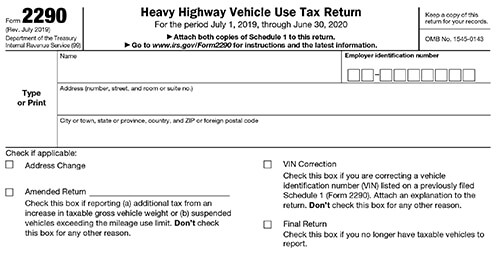

Form 2290 (Rev July ) Department of the Treasury Internal Revenue Service (99) Heavy Highway Vehicle Use Tax Return For the period July 1, , through June 30, 21 Attach both copies of Schedule 1 to this return Go to wwwirsgov/Form2290 for instructions and the latest information Keep a copy of this return for your records

4 Things You Need To Know When Filing Your 21 Hvut Form 2290 Blog Expresstrucktax E File Irs Form 2290 Online

Irs Hvut Form 2290 E File Hvut Form 2290 Online Filing Online Form 2290 Schedule 1 Precise2290 Com

3 11 23 Excise Tax Returns Internal Revenue Service

Home Form 2290 Schedule 1

Pin On Form 2290

Download Instructions For Irs Form 2290 Heavy Highway Vehicle Use Tax Return Pdf Templateroller

E File Your Truck Tax Form 2290 Highway Heavy Vehicle Use Tax

E File Irs Form 2290 Help Videos Expresstrucktax

Irs Tax Forms Internal Revenue Code Simplified

E File Form 2290 File 2290 Online 9 90 Quick Secure

Eform2290 Is An Irs Authorized 2290 Efile Provider Form 2290

Form 2290 Pdf Fill Online Printable Fillable Blank Pdffiller

Download Instructions For Irs Form 2290 Sp Declaracion Del Impuesto Sobre El Uso De Vehiculos Pesados En Las Carreteras Pdf Templateroller

21 Irs Printable Form 2290 Fill Download 2290 For 6 90

Form 2290 Instructions Truckdues Com To E File Vehicle Use Tax Starts From 7 99

4 Things You Need To Know When Filing Your 21 Hvut Form 2290 Blog Expresstrucktax E File Irs Form 2290 Online

Faqs For Form 2290 Due Date Cost E Filing And More

Office Of Highway Policy Information Policy Federal Highway Administration

3 11 23 Excise Tax Returns Internal Revenue Service

E File Irs Form 2290 Help Videos Expresstrucktax

Form 2290 Filing Irs 2290 Online File 2290 Electronically

Form 2290 Deadline Is Here In Irs Drivers Education Tax Forms

Irs Form 2290 Online Filing 2290asap

How To E File Form 2290 For 21 Tax Period

Form 2290 Filing Irs E File With Form 2290 Heavy Vehicle Use Tax

24 Printable Irs Form 2290 Templates Fillable Samples In Pdf Word To Download Pdffiller

Irs Form 2290 Due Date For 21 22 File 2290 Now

Irs 2290 Payment To Irs 2290 Taxes Are Due Now For 21 By Form2290filing Issuu

2290 Excise Tax

Download Instructions For Irs Form 2290 Heavy Highway Vehicle Use Tax Return Pdf Templateroller

Efile Form 2290 Heavy Highway Use Tax Irs 2290 Form H

Last Day To File Form2290online For 21 Taxyear Tax Forms Irs Forms Form

Form 2290 Online Filing 19 E File Hvut Form 2290 With Ez2290 Com Youtube

Irs Form 2290 Heavy Vehicle Use Tax Return

Irs Form 79 Ex Download Fillable Pdf Or Fill Online Irs E File Signature Authorization For Forms 7 2290 And 49 Templateroller

Tax Office Traviscountytx Gov Files Vehicles 2290 Pdf

Form 2290 Filing Irs E File With Form 2290 Heavy Vehicle Use Tax

Irs Form 2290 Schedule 1 2290 Proof Of Payment

10 Advantages To File Irs Form 2290 In An Online Process For The Tax Year 19 By Efileform 2290 Medium

Efile Form 2290 Heavy Highway Use Tax Irs 2290 Form H

Download Instructions For Irs Form 2290 Heavy Highway Vehicle Use Tax Return Pdf Templateroller

Irs Form 2290 For 19 Edocr

How Many Times Do I Need To File Form 2290 Golden Tax Relief

Form 2290 Filing Irs 2290 Online File 2290 Electronically

Office Of Highway Policy Information Policy Federal Highway Administration

Here S How To Claim A Tax Credit On Your Form 2290 For The 21 Tax Year Expressamber Youtube

Irs Form 2290 Schedule 1 E File Form 2290 Online Irs 2290 Taxes

Form 2290 For 19 Truckdues Com To E File Vehicle Use Tax Starts From 7 99

Pre File 2290 Form With Irs And Get Stamped Schedule 1 For 21 22

File Irs Tax Form 2290 Online For 19 Form2290filin Flickr

Jucf2ekrbmbfsm

Form 2290 Irs Tax Filing For The Tax Year 18 19

E File 2290 E File Irs Hvut Form 2290 Online And Get Schedule 1 Copy

Irs Watermarked 2290 Proof Of Payment Schedule 1in Minutes Tax2290 Com

E File Form 2290 Online Irs Hvut Form 2290 E File Online Form 2290 Taxseer2290 Com

Deadline Today Tax 2290 Blog

Form Irs 2290 Fill Online Printable Fillable Blank Pdffiller

Form 2290 Heavy Highway Vehicle Use Tax Return

Heavy Highway Vehicle Use Tax Form 2290 Lovely Form Line Cropped Filing E W10 Phenomenal 2290 Models Form Ideas

Irs Form 2290 E File What Is It E File Irs Form Federal Tax Forms Hvut 2290 Form 1099 Form

Learn How To Fill The Form 2290 Internal Revenue Service Tax Youtube

File 2290 Online With Huvt Form 2290 Heavy Highway Vehicle Use Tax

Form 2290 An Overview Due Date Filing Methods Mailing Address

1

How To Avoid Hvut Form 2290 Penalties Blog Expressefile Create Fillable Form W2 1099 Misc 941 2290

Irs Form 2290 Filing To Pay Heavy Vehicle Use Tax Irs E File 2290

How To Pre File Form 2290 Online For Tax Year 21 Using Taxseer2290 By Taxseer2290 Issuu

Pre File Form 2290 For 21 Tax 2290 Blog

How To File Your Own Irs 2290 Highway Use Tax Step By Step Instructions Youtube

24 Printable Irs Form 2290 Templates Fillable Samples In Pdf Word To Download Pdffiller

E File Form 2290 For 21 And Receive Watermarked Schedule1 On July 1 Tax Irs Tax Forms

コメント

コメントを投稿